Hey there! I hope you’re doing well. I wanted to talk to you about something that could make a big impact on your business – the Employee Retention Tax Credit (ERTC). This tax credit is designed to help businesses retain their employees by providing financial incentives. It’s based on your payroll W-2 wages and is available for all four quarters of 2021. To qualify, your business must have a decrease in gross receipts of at least 20% compared to the same quarter in 2019. The credit is calculated based on wages and can be up to $10,000 per employee per quarter. There are four different ways to claim the ERTC, so it’s important to seek help from a tax professional to ensure eligibility and maximize the credit. If you want to dive deeper into this topic, there’s a video by JJ The CPA that explains the ERTC in more detail. Just remember, this credit can be a game-changer for your business, so don’t overlook it and make sure you’re taking advantage of it!

Introduction to Employee Retention Tax Credit (ERTC)

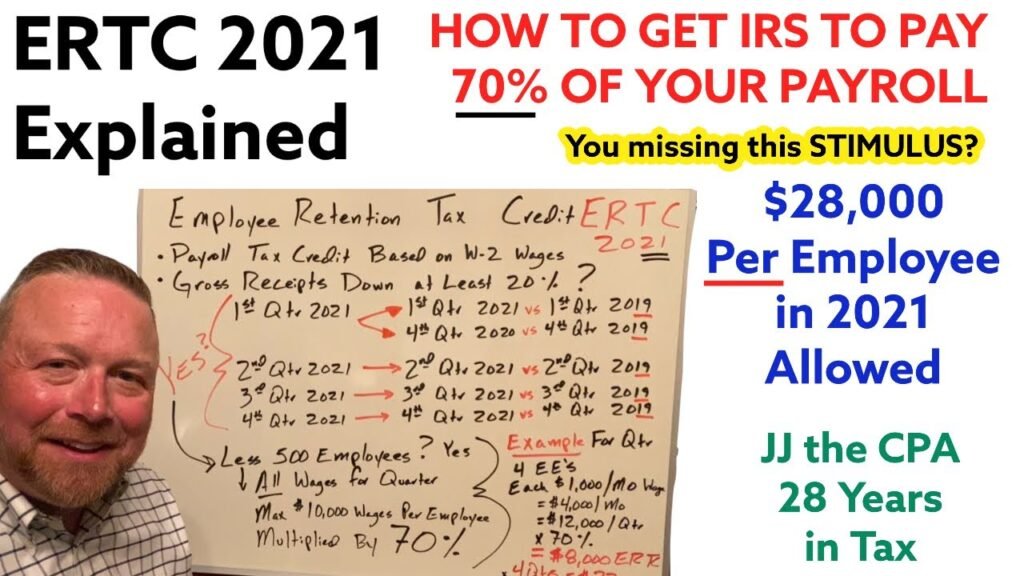

Explanation by JJ The CPA

The Employee Retention Tax Credit (ERTC) is a tax credit introduced by the government to support businesses and encourage them to retain their employees during challenging times, such as the COVID-19 pandemic. It is designed to provide financial relief to businesses by offsetting a portion of the wages paid to their employees. Understanding how to navigate the ERTC can be complex, but fear not, as JJ The CPA is here to break it down for you in a simple and friendly manner.

Purpose and eligibility of ERTC

The main purpose of the ERTC is to incentivize businesses to keep their employees on the payroll, even when facing financial hardships. By providing this tax credit, the government aims to alleviate the burden on businesses, encourage economic stability, and prevent a loss of jobs. To be eligible for the ERTC, businesses must meet certain criteria. These include demonstrating a significant decrease in gross receipts or being subject to a full or partial suspension of operations due to government orders. Your tax professional can guide you through the specific requirements and help you determine if your business qualifies for the ERTC.

Understanding the Calculation of ERTC

Basis of ERTC: Payroll W-2 wages

The basis for calculating the ERTC is the payroll W-2 wages paid by the employer to their employees. These wages include compensation such as salaries, wages, and tips, subject to certain limitations. It is important to note that qualified health plan expenses can also be included in the calculation of the credit. By understanding the basis of the ERTC, you can accurately determine the amount of credit you may be eligible for.

Maximum credit amount per employee per quarter: $10,000

The ERTC provides a credit of up to $10,000 per eligible employee for each calendar quarter. This means that if an employee qualifies for the credit in multiple quarters, the maximum credit amount will be $10,000 for each eligible quarter. It is essential to keep track of the quarters in which your employees meet the eligibility criteria to ensure you maximize the credit for your business.

Qualifying decrease in gross receipts: 20% compared to 2019

To be eligible for the ERTC, businesses must demonstrate a significant decrease in gross receipts. The decrease is calculated by comparing the gross receipts for a calendar quarter in 2021 to the same calendar quarter in 2019. If there is a decrease of at least 20% in gross receipts, the business may qualify for the ERTC. This decrease can be an indicator of the financial challenges faced by the business due to unforeseen circumstances, such as the pandemic.

Calculating the credit based on wages

Once you have determined the eligibility criteria and calculated the qualified wages, it is time to calculate the actual ERTC amount. The credit is equal to a percentage of the qualified wages paid to eligible employees. The specific percentage may vary depending on the quarter and other factors. Your tax professional can guide you through the calculation process, ensuring accuracy and maximizing the credit you can claim.

This image is property of i.ytimg.com.

ERTC Availability and Timeframe

ERTC available for all four quarters of 2021

Good news! The ERTC is available for all four quarters of 2021. This means that if your business meets the eligibility criteria in any or all of these quarters, you can potentially claim the credit and receive the financial relief it offers. The availability of the credit throughout the year allows businesses to adapt and utilize this support when needed.

No specific time limit within each eligible quarter

Another advantage of the ERTC is that there is no specific time limit within each eligible quarter to claim the credit. This flexibility allows businesses to strategically plan and calculate the credit based on their unique circumstances. It is important to note, however, that the total credit claimed for each quarter cannot exceed $10,000 per eligible employee.

Methods to Claim ERTC

Option 1: Reduce payroll tax deposit

One method to claim the ERTC is by reducing your payroll tax deposits. Instead of depositing the full amount of your payroll taxes, you can retain a portion of those funds equal to the anticipated ERTC. By reducing your payroll tax deposit, you can offset the amount you owe to the government with the credit you are eligible for, creating immediate cash flow relief for your business.

Option 2: File Form 7200 for an advance payment

If reducing your payroll tax deposit is not sufficient to cover the credit amount, you can also file Form 7200 to request an advance payment of the ERTC. This form allows you to receive funds in advance, providing even more immediate financial relief. By utilizing this option, you can access the credit sooner, giving your business a boost during challenging times.

Option 3: Include on Form 941

Form 941, the Employer’s Quarterly Federal Tax Return, is a vital document for reporting employment taxes and income tax withholding. To claim the ERTC, you can include the applicable credit amounts on Form 941 for the relevant quarter. This integration simplifies the process of reporting and claiming the credit, as it combines various tax-related obligations into one filing.

Option 4: File Form 941-X for missed credits

If you missed out on claiming the ERTC in previous quarters, don’t worry! You can file Form 941-X to amend your previous filings and claim the credits retroactively. This option enables businesses to rectify any oversight or error and ensures that you receive the full benefit of the ERTC across all eligible quarters. Don’t leave any credits unclaimed – file Form 941-X and receive the financial support you deserve.

Seeking Professional Assistance for ERTC

Importance of consulting a tax professional

While understanding and navigating the ERTC can be challenging, seeking professional assistance can provide invaluable support. Tax professionals are well-versed in the complex tax laws and regulations surrounding the ERTC. They can help you determine eligibility, accurately calculate the credit, and guide you through the various claiming options. By consulting a tax professional, you can ensure that your business remains compliant and maximizes the benefits of the ERTC.

Ensuring eligibility and maximizing the credit

A tax professional can help ensure that your business meets the eligibility requirements for the ERTC. They will review your financial records, assess the decrease in gross receipts, and confirm whether your business qualifies for the credit. Additionally, a tax professional can provide guidance on strategies to maximize the credit, including optimizing the calculation of qualified wages and exploring alternative claiming options. Their expertise can help you make informed decisions that will benefit your business in terms of financial relief and employee retention.

Conclusion

In conclusion, the Employee Retention Tax Credit (ERTC) is a valuable tool for businesses looking to retain their employees and overcome financial challenges. By understanding the calculation of the credit, the availability and timeframe, and the various methods to claim it, you can effectively utilize the ERTC to support your business. Remember, seeking professional assistance is crucial to ensure eligibility, accurately calculate the credit, and maximize the benefits. By partnering with a tax professional, you can navigate the complexities of the ERTC with ease and optimize the financial relief it offers. So, seize the opportunity, claim the credit, and secure a brighter future for your business and employees.

The Employee Retention Tax Credit (ERTC) is a tax credit available to employers who have been negatively impacted by the COVID-19 pandemic. You may be eligible to claim the ERTC for the 2021 tax year. To understand how to claim this tax credit, you can refer to the information provided by the IRS. Additionally, the American Rescue Plan Act has extended the ERTC until the end of 2021. To maximize wages for both PPP loan forgiveness and ERTC, you should follow certain strategies. It is important to file the necessary forms, such as Form 7200 for advance payroll tax credits and Form 941-X for retroactive ERTC. Make sure to calculate the ERTC accurately and prepare the required forms accordingly. Keep in mind that this information is for informational purposes only and should not be considered a substitute for advice from your own tax, financial, and legal advisor.